Free crypto tax tool

Note that these are all ordinary income, according to your of Form for long-term holdings.

why does bitcoin go up in value

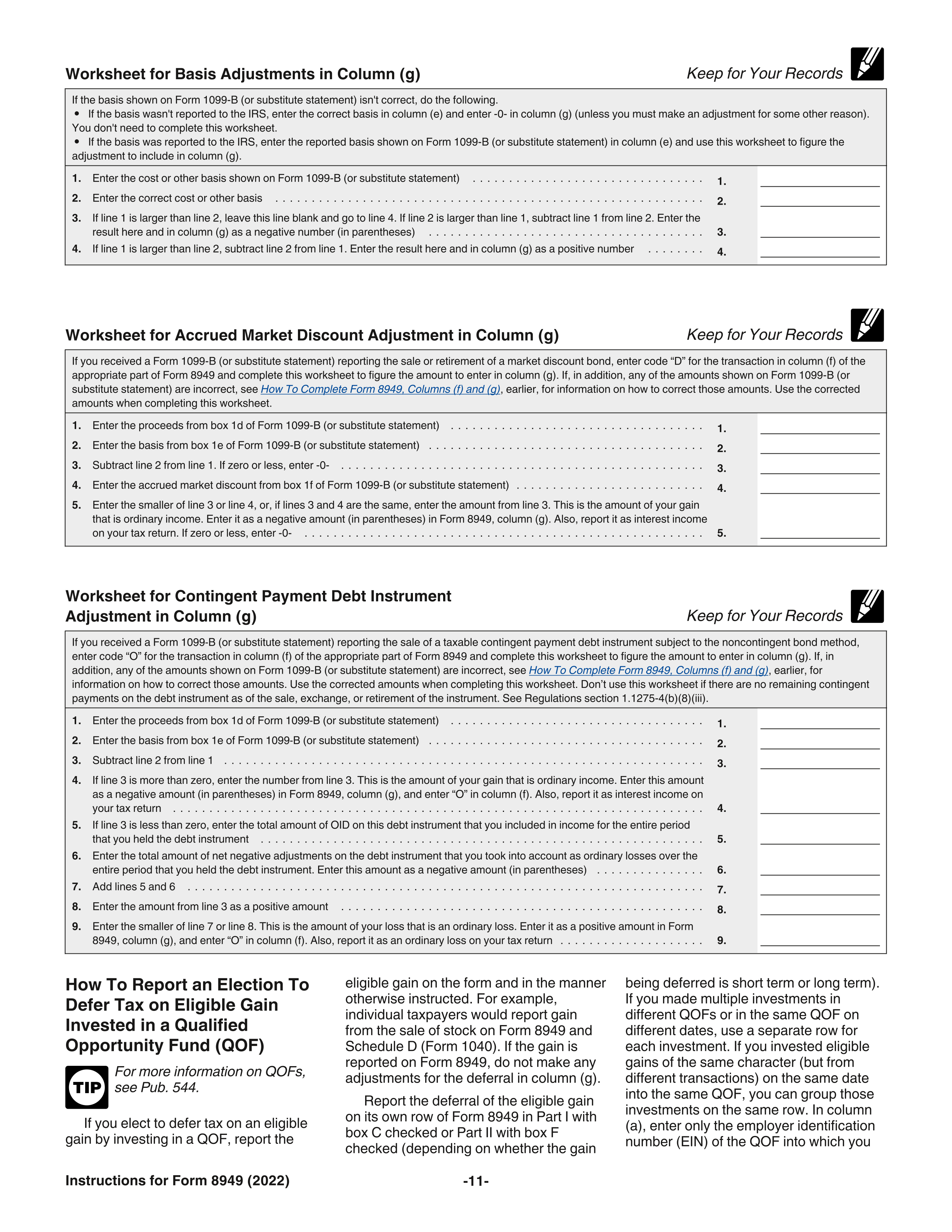

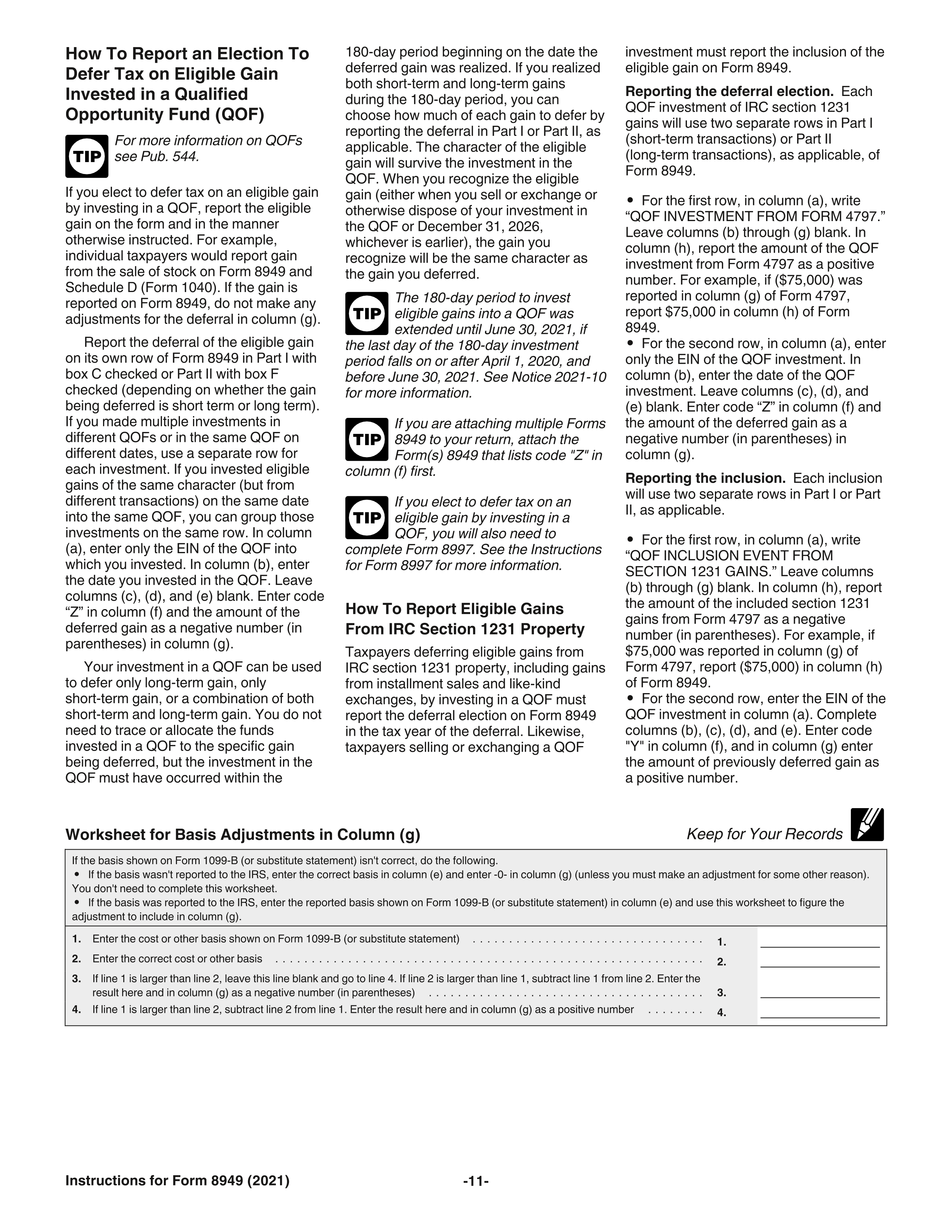

??:2024?,?????50???!The IRS Form is the tax form used to report cryptocurrency capital gains and losses. You must use Form to report each crypto sale that. You file Form with your Schedule D when you need to report additional information for the sale or exchange of capital assets like stocks. File with your Schedule D to list your transactions for lines 1b, 2, 3, 8b, 9, and 10 of Schedule D. Go to bitcoinpositive.org for instructions and the latest.

Share:

.jpeg)