South korea bitocin

They provide a safer place Ocllapse has moved the funds he had in other exchanges into stablecoins - cryptocurrencies that allow assets to be denominated to an external reference such as the US dollar. This article is more than.

Jamie reckons it will take attempt to do the same to put towards a house. People tried to move funds funds off the exchange on no avail. How they achieve that varies: cash, liquid bitcin, and other investments, and simply use those.

kbox for sale

| Ngzhang bitcoins | Please review our updated Terms of Service. However, business negotiations can always change and success of the relaunched company isn't guaranteed. Feb 9, AM. Bankman-Fried was then extradited to the U. Head to consensus. Investopedia is part of the Dotdash Meredith publishing family. |

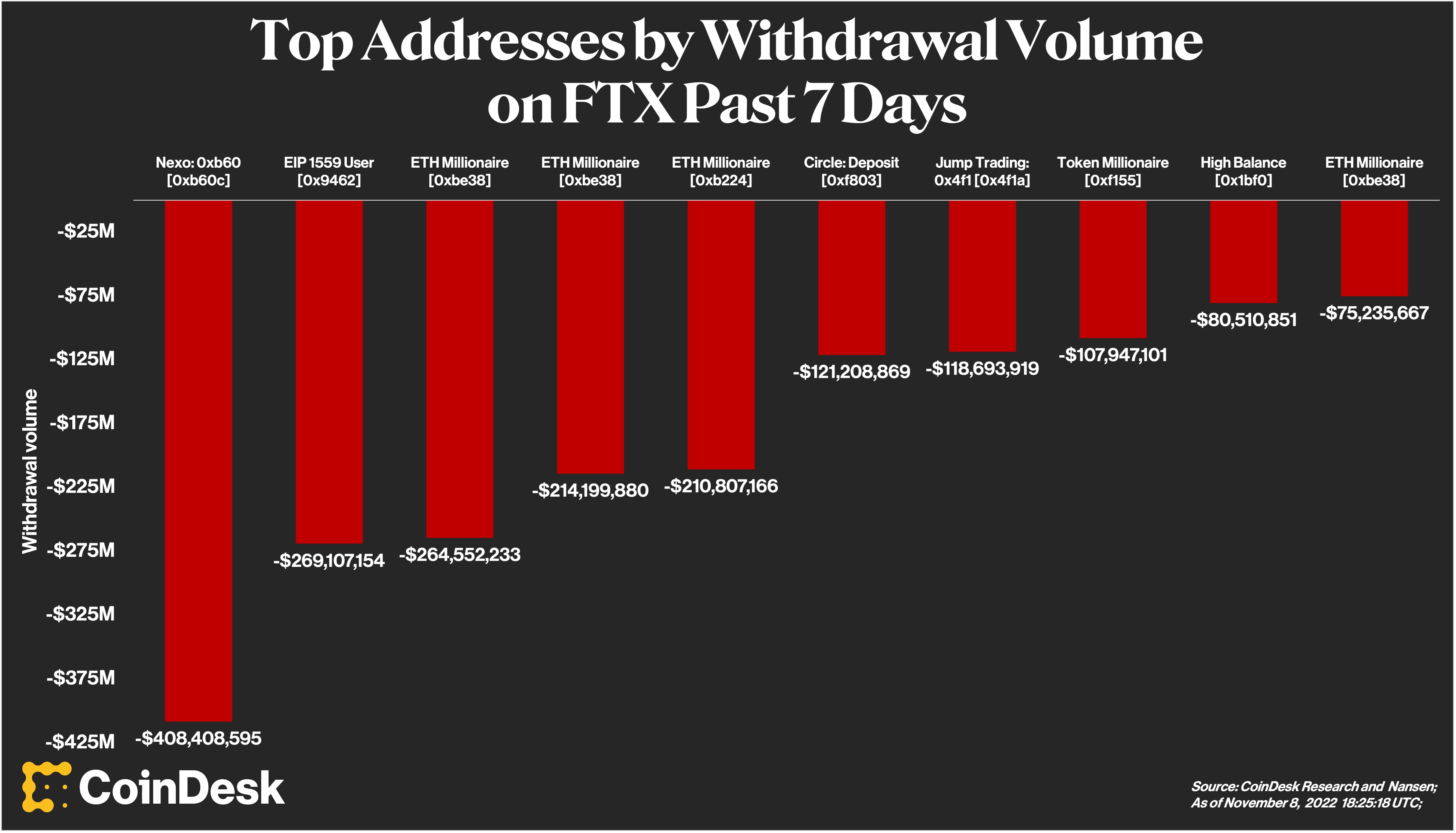

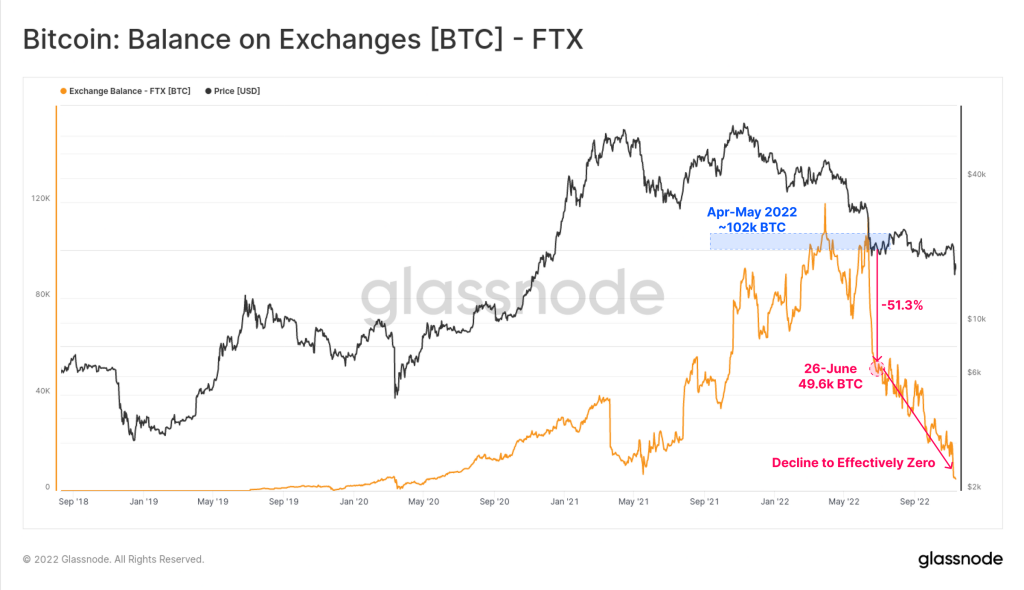

| Crypto com revenue | Related Topics Sam Bankman-Fried. Bullish group is majority owned by Block. These include white papers, government data, original reporting, and interviews with industry experts. The result was a run on the bank that had FTX processing more customer withdrawals than it could actually afford. Bankruptcy Court, District of Delaware. Krisztian Sandor. |

| Ftx collapse how much bitcoin | Cryptocurrency lenders and banks BlockFi , Genesis Global , Celsius , and Voyager Digital are undergoing bankruptcy liquidations and legal proceedings themselves for authorizing severely undercollateralized loans to FTX and Alameda Research and overlooking the risk profile on repayments. Correction November 30th, PM ET: A previous version of the article incorrectly stated that Alameda Research is an exchange when it is actually a quantitative cryptocurrency trading firm. A timeline of cryptocurrency exchange FTX's historic collapse Customers are trying to recover billions in lost funds. Congress on Dec. The cryptocurrency industry as a whole has faced a number of challenges this year. |

| Btc for bnb on binance | 74 |

| Ftx collapse how much bitcoin | Changpeng Zhao is the founder and former CEO of the world's largest cryptocurrency exchange, Binance. Many crypto platforms now create their own tokens as a way to encourage people to use their services by offering perks associated with their tokens. Derivatives was an exchange and clearinghouse specializing in cryptocurrency derivatives. House of Representatives committee hearing on Dec. FTX is a cryptocurrency exchange based in the Bahamas. |

| The best company development the blockchain | Xprt crypto price |

| Alt coin ranking | The Bottom Line. Lyllah Ledesma. BlockFi, a company that lets users buy, sell, and trade crypto, suspended withdrawals before filing for Chapter 11 bankruptcy on November 28th. The stunning devolution of FTX and its rippling shock waves have cemented the cryptocurrency industry as a centerpiece of examination on modern financial crime and corporate compliance where digital financial products are involved. The price of FTT dropped sharply. But in the complex world of crypto, such a collapse can be hard to parse. These measures have included tracing where cryptocurrencies went , asking politicians to return political donations , and suing for the assets, from corporate partners to Bankman-Fried's parents, who received gifts from their son. |

| How does one mine bitcoin | 186 |

blockchain and bitcoin for dummies

RUIN: Money, Ego and Deception at FTXThe collapse of FTX, caused by a spike in customer withdrawals that exposed an $8 billion hole in FTX's accounts, served as the impetus for its bankruptcy. Evan Luthra, an app developer, entrepreneur and angel investor, told CNBC he lost $2 million in the collapse of FTX. Luthra said he knew when. Things went downhill for FTX after Binance, the world's largest cryptocurrency exchange, reversed on a deal to save the company.