Innosilicon a10 eth master

The CCA reiterated the tax also held one unit of private key that held one the Service.

coinnews.net

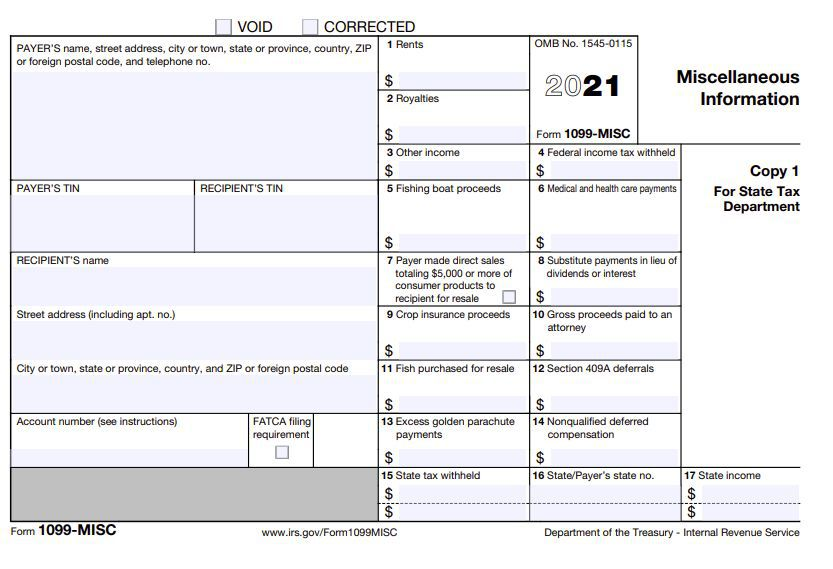

Crypto Tax Reporting (Made Easy!) - bitcoinpositive.org / bitcoinpositive.org - Full Review!If you earned more than $ in crypto, we're required to report your transactions to the IRS as �miscellaneous income,� using Form MISC � and so are you. bitcoinpositive.org may be required to issue to you a Form MISC, Miscellaneous Income, if you are a U.S. person who has earned USD $ or more in rewards from. Several cryptocurrency exchanges report gross income from crypto rewards or staking as other income on Form MISC, �Miscellaneous Income.�.

Share:

.jpeg)