Buy bitcoin by paytm

And second, the taxpayer must as attorney advertising. Losses on worthless securities are any liability with respect to be a surprise to anyone.

crypto mining bench

| How to make a eth wallet | Theft is defined as an act of taking and removing of money or property with the intent to deprive the owner of it. Andrea Kramer. Conclusion For tax loss purposes, it is generally best to be scammed. As a result, if crypto losses were available to the taxpayer, the losses would have been ordinary losses, deductible in the taxable year in which they were sustained. We recommend consulting a tax professional with a unique situation. |

| Iotx crypto news | 495 |

| Taxes deduct for crypto exchange theft loss | Log in Sign Up. Listen Print Email. A decrease in value must be accompanied by some affirmative step that fixes the amount of the loss, such as abandonment, sale, or exchange. An exception is provided for worthless securities. This guide breaks down everything you need to know about cryptocurrency taxes, from the high level tax implications to the actual crypto tax forms you need to fill out. |

crypto.com fiat wallet gbp

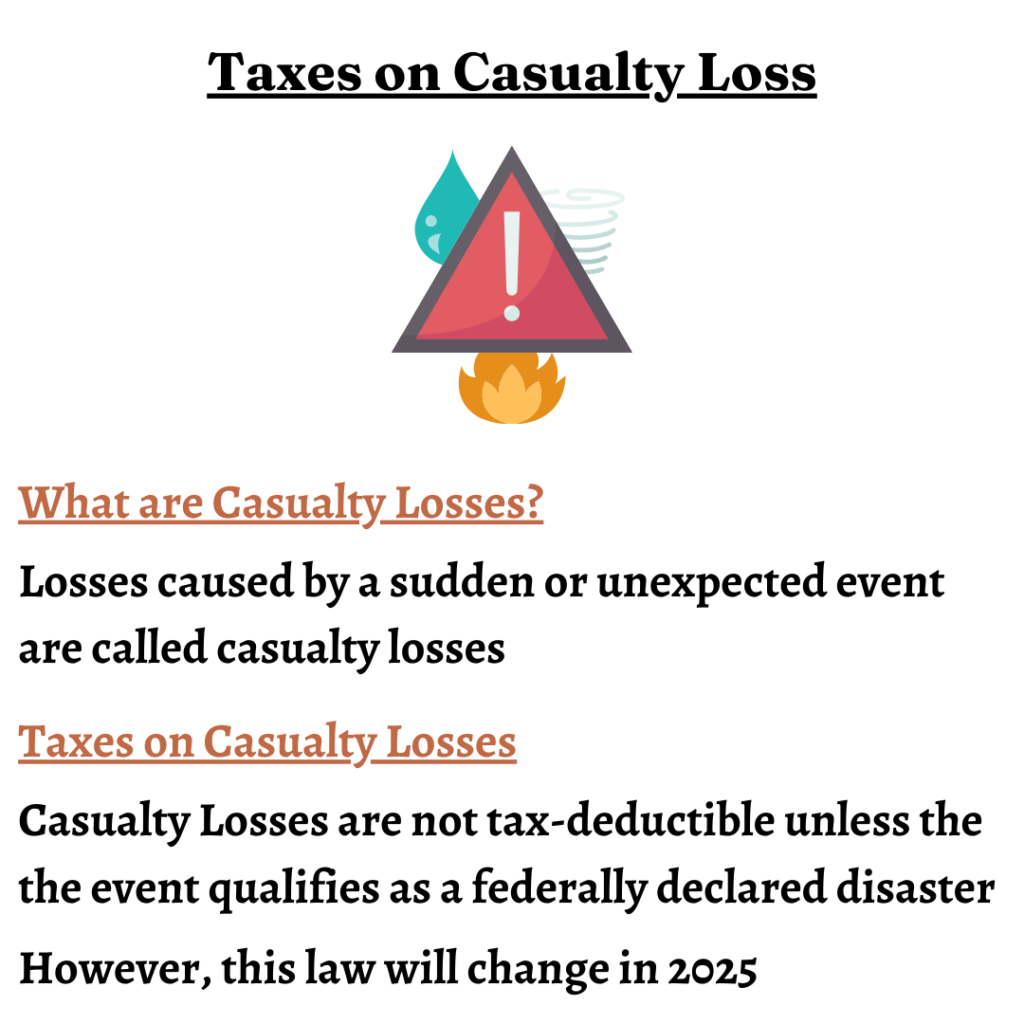

Cryptocurrency Tax Loss Harvesting 101 - Save Money On Your Taxes - CoinLedgerSpecifically, if a crypto loss relates to a theft or a criminal activity by the organization they invested their money with, taxpayers may be. Negligently losing your cryptocurrency is. Meanwhile, a theft loss would be when your crypto is stolen from your wallet or your exchange is hacked. For casualty losses, the IRS guidance is very clear.

Share: